Payment App Accounts Should Be Considered in Your Estate Plan

The Internet never forgets. That maxim is most often used to warn people about posting embarrassing or controversial material, but it also applies to things like digital accounts which can go on long after we’re gone. Modern estate plans need to consider what happens to these digital assets when the owners of these accounts die.

Digital accounts are every bit as important in estate planning today as other financial holdings, including retirement accounts and bank accounts. Many people use payment apps like Apple Pay, PayPal, and Venmo. The use of these accounts can present a challenge to your loved ones when the time comes to close them down. A digital estate plan can make the process much simpler.

How to Close a PayPal Account

Since its inception in the late 90s, PayPal has grown into a behemoth in the online payment industry in the United States. Three-quarter of the respondents in a recent survey indicated that they use PayPal.1

PayPal’s guidelines state that, in order to close a deceased person’s account, you must be the executor of the estate or an authorized administrator.2 They lay out the steps necessary to allow their Deceased Account Team to close the account. The required documents include:

- A cover sheet listing the PayPal account’s primary email address

- The email address of the person making the request

- A copy of the requestor’s government-issued ID

- A copy of the death certificate

- The document that establishes the requestor’s authority as authorized administrator or executor of the estate

- Upon receipt of the required documentation, PayPal either provides a check for the balance of the account, or provides access to the bank account linked to the PayPal account in order to transfer the remaining funds. The account will then be locked or closed by PayPal.

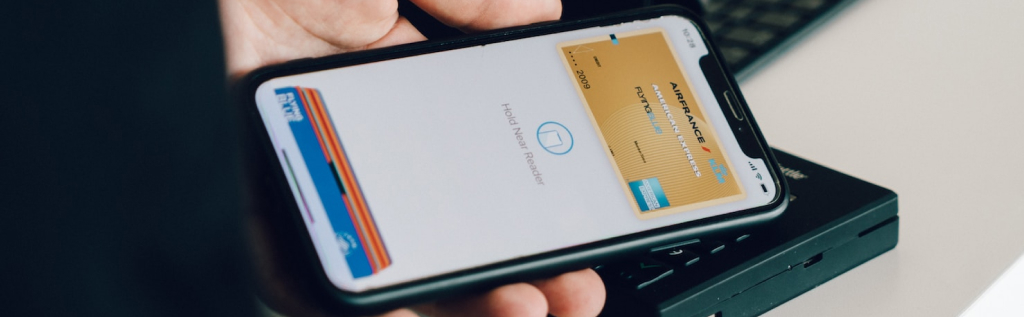

How to Close an Apple Pay Account

Other digital payment services had a head start on Apple Pay, but since its release in 2013 it has become a powerful presence in the space. Apple Pay now reportedly processes more money in transactions per year than MasterCard.3

Apple Pay is more of a service than an app, and is compatible with a wide range of Apple devices. One publication described Apple Pay as the “linchpin” connecting Apple Card, Apple Cash, debit and credit cards into an integrated digital payment system known as Apple Wallet.4

Apple Pay and other services are accessible through an Apple ID account. According to the terms listed by the company, there are three available methods to access and then delete an Apple ID belonging to a deceased loved one. The least desirable method involves obtaining a court order stating the pertinent information5, including:

- The name and Apple ID of the deceased

- The identity of the rightful inheritor of the account

- That the decedent was the user of all accounts associated with the Apple ID

- That the person making the request is the legal personal representative, agent, or heir of the decedent whose authorization constitutes “lawful consent”

- That Apple is ordered to grant access to the account

It’s possible to avoid the need for a court order. Apple ID account holders can name one or more people as Legacy Contacts6. When you choose a Legacy Contact, you generate an access key that they will need upon your passing. With that key and a copy of the death certificate, the Legacy Contact gains temporary access to the account so the Apple ID can be deleted.

The final method is to use the decedent’s Apple ID and the proper legal documents to request that the account be deleted. These requests can be made here.

How to Close a Venmo Account

After a successful launch in 2009, Venmo was purchased by PayPal in 2013. Since then, Venmo has grown to serve around 80 million users, primarily in the US market.7 These users go to Venmo to make digital payments, transfer funds, and get direct deposits, often, but not always, from friends and family. The app is tied to the bank and credit card information of the user, just like PayPal.

According to the Venmo help center, the process for notifying them when a customer who held a Venmo Credit Card through Synchrony Bank has passed involves a specific form.8 The form requires the following information:

- Name of the deceased cardholder

- Address tied to the card

- Account number

- Social Security Number of the cardholder

- Identity of the executor of the estate

- Identity of next of kin

- Requestor’s name

Closing a Venmo account requires the assistance of the Venmo support team. There are two ways this can work. The help request form can be submitted by the customer or by a non-Venmo customer on behalf of the decedent. The form allows you to attach the necessary documentation, including:

- Legal authorization to act on behalf of the deceased

- A copy of the decedent’s death certificate

You can also call the Venmo support team at 855-812-4430.

Digital Assets Should Be Part of Your Estate Plan

PayPal, Apple Pay and Venmo are just three of the options people use to make digital financial transactions. There are some with established protocols that are simple to follow and others that may require more time and energy when it comes to closing the account of a user who has passed away.

With proper planning, you can reduce the stress on your loved ones when it comes to resolving these issues. A digital estate plan should clearly lay out the various accounts you have active and store the credentials you use to access them. Login and password information should be kept in a manner that is secure but also allows access to the people who’ll need it. Password manager applications, including LastPass and 1Password, can allow a trusted family member to find the pertinent information in one place, should the need arise. If you prefer, you can also create a password-protected document or a physical list of your passwords, provided the data is kept safe.

There are several essential things to consider regarding digital estate planning. Will your family know how to log in to all your various accounts? Will your plan be up to date when the time comes? A list of passwords you’ve long since changed is not helpful. Is all the necessary information in the plan? User names, PIN numbers, and authentication methods (including two-factor authentication) must be present for your family to be able to do what needs to be done.

Another vital piece of information is whether you have automatic payments or other accounts tied to your payment apps. Stopping payments that are no longer necessary and settling outstanding bills are easier when it’s clear how all the accounts work together.

Some digital wallets and online payment accounts can retain a positive balance. Your plan should make it clear what you want done with assets that remain in these accounts. Some accounts, including Apple Card, PayPal business accounts, and Venmo group accounts may have more than one stakeholder affected.

A thorough plan, properly maintained will contain all the information about your digital accounts, including how to access and shut down each of them.

It’s possible that you would prefer your digital assets to remain inaccessible upon your death. You have the right to make that choice, but it should be spelled out clearly in your estate plan with the help of an experienced attorney so that no one inadvertently gains access.

Call Our Estate Planning Attorney Today

State law often spells out the steps necessary for trustees, estate administrators, agents and executors to gain access to digital accounts upon the death or incapacity of the account holder. How those laws will apply in your case is something you should consider in advance. Call our Los Altos offices today at 650-325-8276 or contact us online to schedule a consultation about your estate planning needs.

Notes

- Radovan Sekulic, How Many People Use PayPal in 2023?, Moneyzine (Feb. 27, 2023), https://moneyzine.com/personal-finance-resources/how-many-people-use-paypal/.

- Help Center – Personal Account, How do I close the PayPal account of a deceased relative?, PayPal, https://www.paypal.com/us/cshelp/article/how-do-i-close-the-paypal-account-of-a-deceased-relative-help220 (last visited June 28, 2023).

- William Gallagher, Apple Pay processes $6 trillion annually, edges out Mastercard, Apple Insider (Sept. 7, 2022), https://appleinsider.com/articles/22/09/07/apple-pay-processes-6-trillion-annually-edges-out-mastercard.

- Katie Teague & Jessica Dolcourt, Apple Pay, Apple Card and Apple Cash: Disentangling the Payment Features

Apple Wallet houses all three — but what do they do and how do they work together?, CNET (Mar. 29, 2022), https://www.cnet.com/personal-finance/credit-cards/apple-card-vs-apple-pay-vs-apple-cash-differences-you-need-to-know/. - How to request access to a deceased family member’s Apple account, Apple Support (Apr. 4, 2022), https://support.apple.com/en-us/HT208510.

- How to add a Legacy Contact for your Apple ID, Apple Support (Sept. 12, 2022), https://support.apple.com/en-us/HT212360.

- David Curry, Venmo Revenue and Usage Statistics (2023), Business of Apps (Feb. 13, 2023), https://www.businessofapps.com/data/venmo-statistics/.

- Updating your Venmo Credit Card, Venmo Help Center (last visited June 28, 2023) https://help.venmo.com/hc/en-us/articles/360061172554-Updating-your-Venmo-Credit-Card-.