Blog

Red Flags When Hiring a Professional Trustee

Having a Reliable Trustee Is Vital When you create a trust, you need to consider who will run the trust if you become...

Leave Your Retirement Account to Your Minor Child

When it comes to passing on your assets, your retirement savings account is likely one of the largest items to...

Choosing a Non-U.S. Citizen to Be Guardian

The thought of not being able to see to the care and upbringing of your children is a painful one. That pain could be...

5 Federal Taxes That Impact Estate Planning

If you're like most people, the estate tax comes to mind when you think of estate planning. The state of California...

Non-Grantor Trusts and Income Taxes

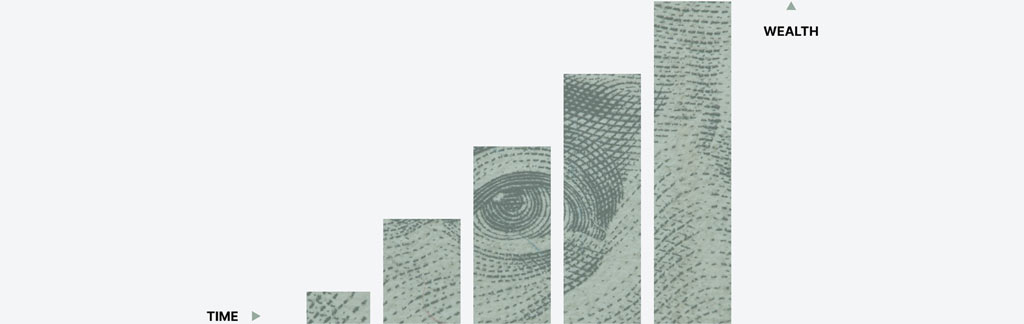

Trusts are some of the most useful tools available to help you build a legacy of wealth and protect assets. In...

How to Protect Your Great Ideas or Works for Your Family

When most people think of estate planning, they think about tax issues, trusts, and passing along assets like...

How to Keep Your Child’s Inheritance Out of Your In-Laws’ Hands

You may have an adult child who is happily married right now, but there’s always the possibility they could get...

Right of Occupancy Trust—A Trust to Protect Your Home and Your Loved Ones

Estate planning is about protecting the people who matter to you most. But sometimes this can be more complicated than...

California Estate Planning – Updated Resource Booklets

We recently published updated versions of my three most popular resource booklets relating to California estate...

Your Financial Power of Estate Plan Attorney: Powerful Provisions

A financial power of attorney is a powerful legal document that gives someone the authority to make decisions if...

Do I Have to Use My Parents’ Estate Planning Attorney for Trust Administration

Parents, when creating a trust, frequently choose one of their children to take over as trustee when the parents are...

What to Do With Medications After Someone Dies?

A loved one’s passing leaves family members to figure out how to handle many different aspects of the person’s life,...

Seven Reasons to Consider a Family Estate Planning Office

Family estate planning offices provide an array of services specifically designed to meet the needs of affluent...

Dealing With Your Spouse’s Debts When They Die

The death of a spouse is an enormous burden for the spouse left behind. During this time of grief and loss, a...

“Encanto” Raises Important Estate Planning Issues

Pop culture isn’t necessarily an accurate source of estate planning information. Still, in some cases, it can raise...

Leaving an Inheritance: Which Distribution Is Best?

As a parent, it may be one of your many goals to leave behind an inheritance for your beloved children. The good news...

Statements of Intent or Purpose in Trusts

California law allows trusts to be created “for any purpose that is not illegal or against public policy.” That very...

The Basics of Gift Taxes

This article is about taxes on gifts made during life, not about taxes that may apply to gifts made after death. The...